Nht Repossessed Houses For Sale In Jamaica 2024 Price

## Navigating the Market: NHT Repossessed Houses for Sale in Jamaica 2024 – Prices and Considerations

Section One

The National Housing Trust (NHT) in Jamaica plays a crucial role in providing affordable housing solutions for its contributors. However, due to various circumstances, some individuals fail to meet their mortgage obligations, leading to repossessions. This creates an opportunity for prospective homeowners to acquire properties at potentially lower prices than those on the open market. Understanding the landscape of NHT repossessed houses for sale in Jamaica in 2024, including pricing and associated factors, is crucial for anyone considering this route to homeownership. Understanding NHT Repossessions: NHT repossessed properties are houses that have been reclaimed by the Trust after the homeowner has defaulted on their mortgage payments. The reasons for default can range from financial hardship, unemployment, illness, or even unforeseen life events. The NHT typically works with homeowners to avoid foreclosure through various avenues, including repayment plans and counseling, but when these efforts fail, repossession becomes the final recourse. Pricing and Availability: Pinpointing exact pricing for NHT repossessed houses in Jamaica for 2024 is challenging due to the fluctuating nature of the real estate market and the varied locations and conditions of the properties. However, several factors generally influence pricing:

Section Two

* Location: Properties in desirable areas, closer to urban centers, with better amenities and infrastructure, will naturally command higher prices than those in more rural or less developed communities. The demand for specific locations greatly impacts the final sale price.

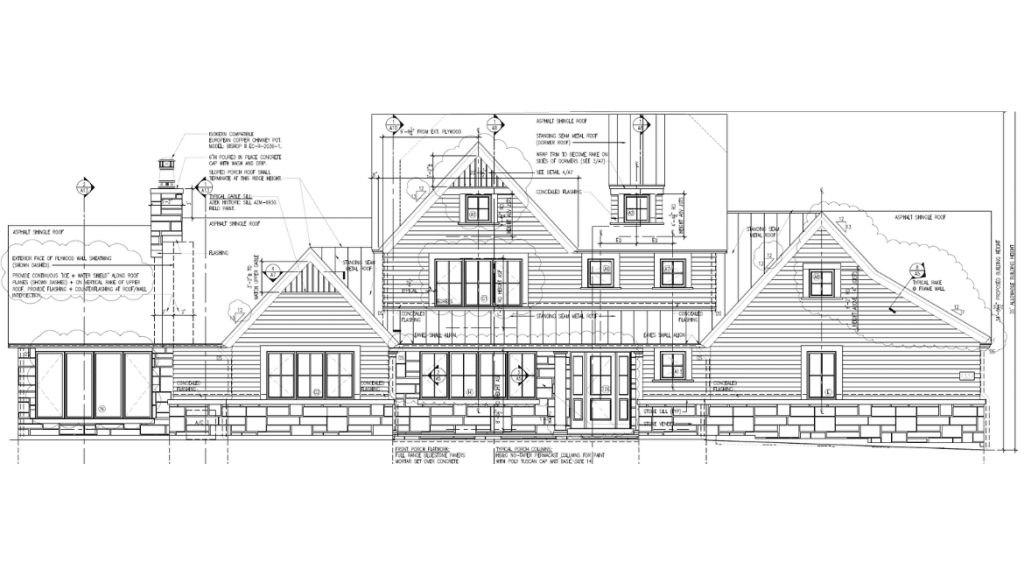

* Property Condition: The state of repair significantly affects value. Houses requiring extensive renovations will be priced lower than those in move-in condition. Factors to consider include the age of the property, the presence of structural damage, and the need for upgrades to plumbing, electrical systems, or roofing.

* Size and Features: Larger homes with more bedrooms, bathrooms, and desirable features like garages, swimming pools, or spacious yards will typically fetch higher prices.

* Market Conditions: The overall health of the Jamaican real estate market influences prices. Periods of high demand may lead to increased prices, while slower markets might offer more competitive rates.

* Sales Process: The NHT's sales process itself influences pricing. They might set a reserve price, or the sale could be through a bidding process, further impacting the final price achieved.

Section Three

While precise pricing cannot be definitively stated, it's generally accepted that NHT repossessed properties are often offered at prices below market value. This discount can be attractive to budget-conscious buyers, but it’s crucial to remember that this lower price may reflect the required repairs or the less desirable location of some properties. Finding Available Properties: Accessing information on available NHT repossessed houses requires diligent effort. The NHT typically advertises available properties through various channels, including:

Section Four

* The NHT Website: The official NHT website is the primary source of information. Check regularly for updates on listings and sales announcements.

* Local Newspapers and Classifieds: Many Jamaican newspapers and online classifieds advertise NHT repossessions.

* Real Estate Agents: Working with a reputable real estate agent specializing in NHT properties can significantly simplify the process. They often have access to listings before they become publicly available. Considerations Before Purchasing: Purchasing an NHT repossessed property presents unique advantages and challenges. Potential buyers should carefully consider the following:

Section Five

* Thorough Inspection: A comprehensive property inspection by a qualified professional is paramount. This will uncover any hidden problems or required repairs, allowing for accurate cost estimations.

* Financing: Securing financing can be more challenging with repossessed properties, as some lenders might be hesitant due to potential risks associated with the property’s history. Pre-approval from a mortgage lender is essential.

* Legal Due Diligence: It's crucial to engage a lawyer to handle the legal aspects of the transaction, including verifying the title and ensuring a clean transfer of ownership.

* Repair Costs: Factor in the cost of any necessary repairs and renovations. This can significantly impact the overall cost of ownership.

* Location and Amenities: Carefully assess the location and its proximity to essential services, schools, and transportation.

* NHT Regulations: Familiarize yourself with the NHT's regulations and procedures concerning the purchase of repossessed properties. Conclusion: Acquiring an NHT repossessed house can be a viable pathway to homeownership in Jamaica, offering potentially significant savings compared to buying on the open market. However, it demands thorough research, careful planning, and a realistic assessment of the potential costs and challenges involved. By understanding the market dynamics, employing due diligence, and seeking professional advice, potential buyers can navigate this process effectively and secure a suitable and affordable home. Remember to regularly check the NHT website and other relevant channels for updates on available properties and sales information throughout 2024. The market changes constantly, so proactive monitoring is key to finding the right opportunity.

Section Six

Section Seven

Section Eight

Section Nine